© 2024 Bemobi. All rights reserved.

In an increasingly Internet-connected society, having a comprehensive and digital payment solution capable of recognizing users' preferences and needs across various online and physical channels, can simplify, expedite, and optimize the collection and billing processes for utility companies, which currently poses a significant challenge for non-digitized industries.

According to a Visa report published in 2023, online transactions in Latin America and the Caribbean have more than doubled in the last four years, reflecting the shift towards digital payments driven by the pandemic and which are now firmly entrenched in the region's economies.

For utility companies, the challenge is even greater. As reported by the Comisión Económica Para América Latina (CEPAL), the extensive lockdowns caused by COVID-19 resulted in a reduction of 0.4% in the regional GDP and a significant accumulation of unpaid bills for basic services after implementing the following emergency measures:

In this scenario, it's not only about digitization, but also about offering diverse payment alternatives and providing flexibility, such as the option to pay in installments to avoid service disruptions at the right time and through appropriate channels, in order to enhance people's lives and significantly reduce the percentage of overdue accounts.

In emerging economies, the customer delinquency rate for essential services such as electricity and water reaches a 40% index due to non-payment.

Once users recognize the need to conduct their tasks digitally, such as paying their basic bills, a tremendous opportunity arises for both public and private companies to enhance these services and provide the best possible user experience.

When we talk about digitization it's not just about offering online services, but also about establishing effective interconnections across all parts of the ecosystem, streamlining transaction steps, and ensuring a robust and secure technological infrastructure. The more stakeholders are committed to this vision, the greater the potential to deliver an improved user experience.

In the report "Digitizing Public Services: Opportunities for Latin America and the Caribbean" prepared by the Inter-American Development Bank in mid-2020, a survey was conducted among citizens from 11 countries. The gathered data revealed a poor experience on the part of users, who stated that conducting their transactions online was "difficult," while 27% of them affirmed that they would never use digital public services again.

Bemobi has revolutionized the world of digital payments through developments focused on traditional companies or industries with low digitalization. Their approach also has the potential to be applied across different industries, such as utilities and wholesaling, enabling effective management of debt levels in their portfolios.

This opens an excellent opportunity for distribution companies to reduce their operating costs by avoiding outsourcing in their collection processes. Currently, utilities own digital channels and POS (Point of Sale) represent only 2% of their collection transactions, in comparison to payments made through physical means, which account for over 50% of the total and are more costly and inefficient.

Spending on digitization within the retail and energy distribution industries will increase from $12.33 billion in 2020 to $33.42 billion in 2030, representing a growth of 10.5%.

The model developed by Bemobi has been crucial in meeting the key demands for communication, digital experience, and payment conversion for new digital users. These needs are shared with other industries, such as utility companies.

The social impact on the lives of our utility customers is quite impressive. When you consider that we offer all possible payment methods, including up to 24 installments, it can change their economic reality. We can see from our statistics that almost 50% of our transactions are made in installments. Therefore, we provide a cash flow solution for these customers to avoid disconnection.

DENIS MAIA

VP de Desenvolvimento Corporativo da Bemobi

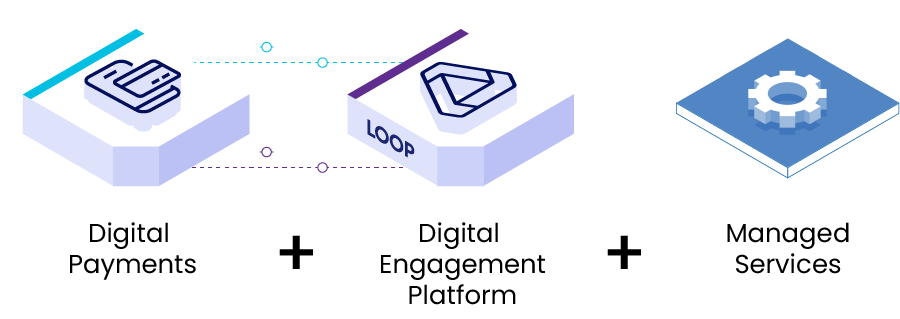

Our solution combines three elements that facilitate the user journey, eliminate friction from the payment process, and improve the contact experience. All of this is made possible by the intelligent integration of communication channels, transaction gateways, and flexible payment conditions, leading to a significant increase in conversion rates and a decrease in delinquency.

That identifies a user’s preferred touchpoints, along with enabling communication and payment channels across the digital ecosystem. This is achieved through the integration of various Inbound channels (mobile and desktop web portals, native mobile apps, kiosks, IVR, etc.) with Outbound channels (smart POS, email, SMS, WhatsApp, RCS, etc).

With an engine integrated with various methods such as debit cards, credit cards, digital wallets, instant payments (Pix in Brazil), and other platforms. This whitelabel engine speeds up time-to-market, providing a complete solution that adapts comprehensively to the demands of the distribution business in a short span.

Offering a wide variety of payment options tailored to users' needs, environments, and preferences.